[fusion_builder_container background_color=”#ffffff” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”” border_style=”solid” padding_top=”20″ padding_bottom=”20″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_title size=”1″ content_align=”left” style_type=”none” sep_color=”” margin_top=”” margin_bottom=”” class=”” id=””]Gas Tax Fast Facts[/fusion_title][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”#f0f0f0″ background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” overlay_opacity=”0.5″ video_mute=”yes” video_loop=”yes” fade=”no” border_size=”0px” border_color=”#f0f0f0″ border_style=”solid” padding_top=”30″ padding_bottom=”30″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=””][fusion_builder_row][fusion_builder_column type=”1_4″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_text]

GAS TAX

[/fusion_text][fusion_imageframe lightbox=”no” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][fusion_text]

[/fusion_imageframe][fusion_text]

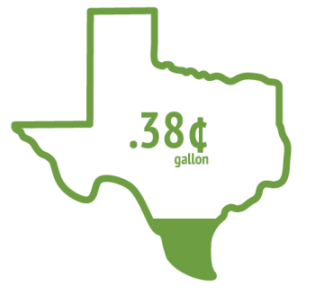

Texas has one of the lowest.

[/fusion_text][fusion_separator style_type=”none” top_margin=”” bottom_margin=”30px” sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=””/][fusion_imageframe lightbox=”no” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_blank” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][fusion_text]

[/fusion_imageframe][fusion_text]

California has the highest.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”3_4″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_text]

The gas tax has not increased since 1993, which means the primary funding mechanism intended to support road construction and transportation has not been adjusted for inflation, increased cost of road construction or the decreasing demand of gasoline (due to technological advancements) in more than two decades.

The following are some interesting facts about the gas tax and how it funds our mobility:

- It’s an excise tax, not a sales tax

- Set in 1991 the current state portion of the gas tax is $0.20 per gallon, and does not fluctuate with gas prices

- Of the state gas tax $0.05 per gallon goes to education, and $0.15 per gallon goes to highway maintenance

- The federal gas tax is $0.18, meaning Texans pay $0.38 per gallon in taxes total

- The typical Texas driver pays about $15.00 a month in state and federal gas tax.

- Texas has one of the lowest gas taxes in the country, nearly $0.10 below average

- California has the highest gas tax at $0.64 per gallon

- Texas has the second highest population in the country at 25,145,561

- With the growth in alternative fuels, new sources of transportation revenue may need to be identified, since the gas tax is only applied to conventional “pay at the pump” fuels

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]